Traders’ Tips

February Issue

“There is always plenty of capital for those who can create practical plans for using it.” Napoleon Hill (Author, Think and Grow Rich, 1883 – 1970)

For this month’s Traders’ Tips, we’ve provided a strategy whose benefit derives more from when it’s used versus what’s traded. We discovered this strategy, like finding a hidden gem, in a place most people don’t consider. Have you ever thought that some of the better odds in trading could be happening right over the market lunch hour (EST)? Using Trade-Ideas OddsMaker we found some amazing results right at the time when most people are not paying attention.

The strategy is based of course on the Trade-Ideas inventory of alerts and filters and backtested with trading rules modeled in The OddsMaker.

Here is the strategy based on finding over-extended moves in price:

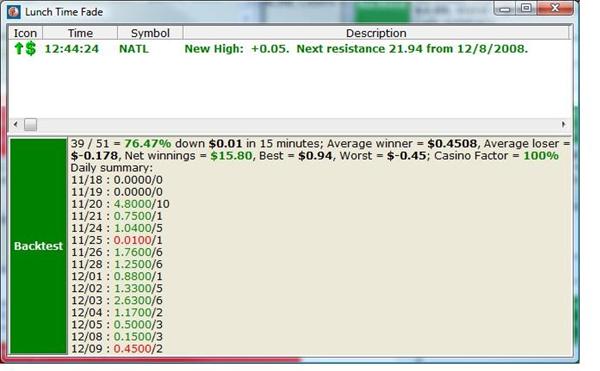

We look for stocks making new highs whose stock price ranges from 5 to 25 dollars. We watch for a specific spread situation where the stocks have at least a 10 cent spread. Additionally the stock’s new high must occur with at least a 65 cent rise over the last 5 minutes to create our interpretation of the over-extended move. The new high trigger is our indication to throw out offers to get short. The results speak for themselves for the 3 weeks ending 12/09/2008: a 76% success rate where average winners are almost 3X as large as average losers.

Provided by:

Trade Ideas (copyright © Trade Ideas LLC 2008). All rights reserved. For educational purposes only. Remember these are sketches meant to give an idea how to model a trading plan. Trade-Ideas.com and all individuals affiliated with this site assume no responsibilities for trading and investment results.

Description: “SHORT – Lunch Time Fade”

Copy this string directly into Trade-Ideas PRO using the “Collaborate” feature (right-click in any strategy window) (spaces represent an underscore if typing):

This strategy also appears on the Trade Ideas Blog: http://marketmovers.blogspot.com/.

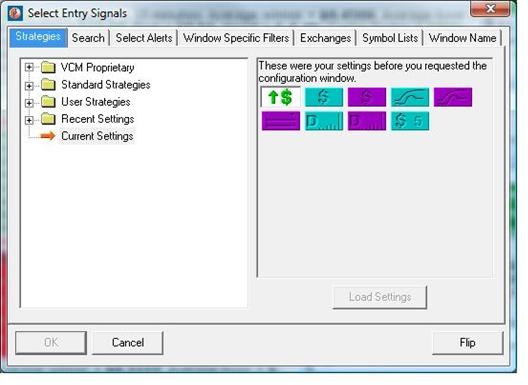

Figure 1.0 below shows the configuration of this strategy:

Figure 1: The combination of alerts and filters

used to create the ‘SHORT – Lunch Time Fade’ strategy

Where 1 alert and 8 filters are used with the following specific settings:

· New High Alert (of the day)

· Min Price Filter = 5 ($)

· Max Price Filter = 25 ($)

· Min Spread Filter = 10 (pennies)

· Max Spread Filter = 100 (pennies)

· Min Distance from Inside Market Filter = 0.01 (%)

· Min Daily Volume Filter = 50,000 (shares/day)

· Max Daily Volume Filter = 2,000,000 (shares/day)

· Min Up 5 Minute Candle Filter = 0.65 ($)

The definitions of these indicators appear here: http://www.trade-ideas.com/Help.html.

That’s the strategy, but what about the trading rules? How should the opportunities the strategy

finds be traded? Here is what The

OddsMaker tested for the past 3 weeks ending 12/09/2008 given the following

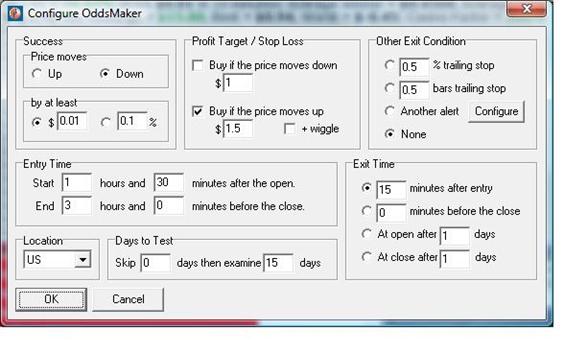

trade rules:

- On each alert, sell

short (price moves down to be a successful trade)

- Buy back the stock if

price moves up $1.50

- Otherwise hold the

stocks for no more than 15 minutes after entry

- Start trading 1 hour

and 30 minutes after the market open

- Stop new trades 3

hours before the end of the market close

As we mentioned earlier, The OddsMaker summary provides the

evidence of how well this strategy and our trading rules did in Figure 2.0.

Figure 2: The OddsMaker backtesting configuration

for ‘SHORT – Lunch Time Fade’